Could you re-finance a home guarantee financing? Its a concern many people are no doubt asking themselves now, provided exactly how common family equity loans and you can house guarantee lines away from borrowing (HELOC) are actually for almost all families.

These types of loans, which permit one to improve commission terms and conditions regarding your home or draw upon collateral contained within it to assist pay for repairs otherwise home improvements, could render a helpful monetary product. But it is not unusual in order to plus desire to re-finance a house security loan a process that can be so you can easily, and also at times recommended based on your own personal things.

Would you Refinance A home Collateral Financing?

Even as we talked about over, trying out property guarantee financing or HELOC can mean taking toward more risks of another financial while the associated repayments. All things considered no matter if, it’s not strange to want to help you re-finance a house equity loan when you can safer a far greater interest or more advantageous commission means. Actually, doing so could make you stay more income flow self-confident, and better capable satisfy payment per month debt.

Reasons why you should Re-finance A property Guarantee Mortgage:

- We want to secure less rate of interest on your own home guarantee financing otherwise HELOC on account of lower real estate market notice pricing.

- We want to button out-of a variable-rates loan so you’re able to a fixed focus-price mortgage as an alternative (or the other way around, dependent on your needs).

- You may have an importance of a bigger family collateral loan otherwise HELOC to incorporate better monetary exchangeability and take additional money loans Jewett City CT aside of your house.

- We wish to safer an extended fees name and you may/or reduced payment loans.

- We should get rid of or prevent a beneficial balloon payment.

This basically means, if you have a property collateral financing, you happen to be considering the opportunity to capitalize on lower desire rates throughout the the term of which day it may be a fine idea so you can refinance. Rather, you can also wish to re-finance your property guarantee financing discover a much bigger financing, otherwise changeover off an adjustable-rate mortgage product (aka variable-price mortgage) so you can a predetermined-rate mortgage service.

Refinancing a property collateral mortgage may also help you have made clear out of highest balloon repayments otherwise alter the title of your financing becoming shorter (letting you build-up guarantee throughout the assets) or lengthened (and so cutting your monthly premiums). Of course, you could usually choose a funds-away re-finance rather, making it it is possible to to help you refinance a current loan having a great another one as a way to grab as much cash-out of the home since your lender lets.

Pros and cons Of Refinancing Your property Equity Loan

- Possibility to exploit down interest levels

- Possibility to changeover away from variable-rates to help you repaired appeal-speed financing

- Can help you get more working capital to have home improvements and you will most other plans

- Now offers an easy way to adjust monthly premiums and payment terms and conditions

How exactly to Re-finance A property Equity Financing

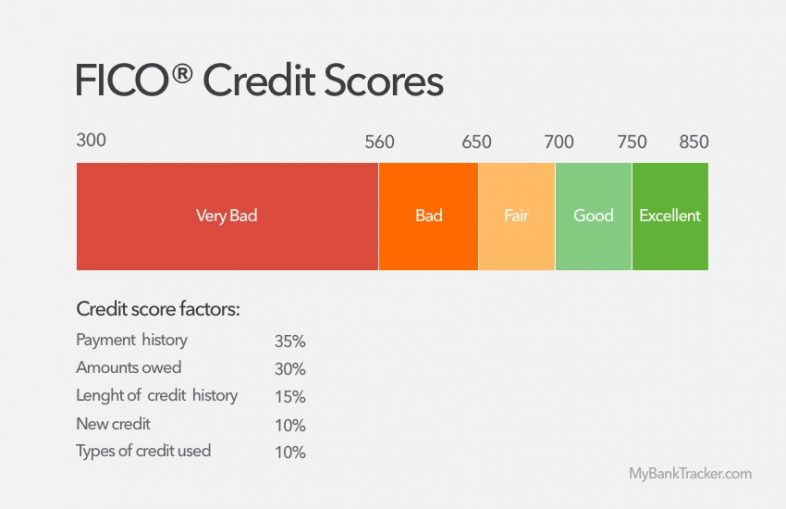

Remember that refinancing a home equity mortgage is comparable into the techniques so you’re able to obtaining home financing, in that attempt to bring detailed financial records starting of tax statements to blow stubs and you may house ideas. Additionally, it can also help to have a top credit history and a lot more good financial obligation-to-income (DTI) proportion when you need to get the very best costs when looking to so you can refinance the HELOC or household guarantee financing.

To help you re-finance property equity mortgage, you will have to make sure the purchase along with your assets and also collected a minimum number of equity of your home. The lender tend to imagine any and all financing and mortgages that you really have currently taken out contrary to the assets. More monetary credit institutions will require you to keeps a mixed financing-to-worth ratio (LTV) away from less than 85%. To phrase it differently, the sum all of your current most recent a fantastic home loan balance do not depict more 85% of one’s house’s total latest really worth.

The bottom line

Typically, you could find you to refinancing a home guarantee financing may help you can get down rates of interest and you may money while also modifying financing cost terminology and you will extending economic repay symptoms.

Also , it may perform an opportunity to key regarding a supply to help you a predetermined-speed loan and you can right back or obtain additional financing if you find that you have to have more income for personal coupons otherwise domestic solutions and you can developments. not, its generally best to set aside refinancing to have times when you’ve dependent right up too much equity of your house, otherwise cost have dropped somewhat as you first acquired a house loan.