From inside the large area centers or even in suburbs discovered alongside biggest locations when you look at the Ontario might have loan providers who will wade since highest since the 85% and even 95% mortgage so you’re able to really worth in the example of property equity financing Toronto. Niagara Drops and you may Grimsby try examples of almost every other a great developing real estate places where people might have accessibility a bigger pool out of equity situated lenders once they go through its look for the right choice for household guarantee funds. As the utmost inhabited state in Canada, Ontario presents an cash advance usa Divide CO extremely glamorous marketplace for private mortgage loans and private loan providers supply so much more competitive repaired cost and conditions, plus particular rarer times variable rate choices, than just equivalent lenders in other real estate markets round the Canada. Assets viewpoints try less likely to drop from inside the Ontario than he could be in other provinces when you look at the Canada, of course they do, they’ll more than likely not go lower really fast or for too long. Because of this, cost toward mortgages and you will household equity financing are going to be straight down also.

Considering the higher fixed interest rates which can be normal with of numerous family guarantee finance and 2nd mortgages. it is crucial that you create certain that you really have a great solid bundle positioned about precisely how you will employ, pay, and you can create new loans and is given to you. A great experienced large financial company might help you using this type of part of the equation.

Recently, and you will considering the not the COVID-19 pandemic, people who own their residence and you may the otherwise experienced advertisers is actually even more turning to the security they own available in their home since the a source of dollars. This is accomplished because the throughout times when the organization community is compelled to close and other people was compelled to stay at home towards the lockdown, money can be reasonable when you are fixed costs such as lease, property tax, private taxation, credit cards, and even particular changeable expenditures normally remain almost unchanged. Its in these situations where those who very own their residence you will definitely make use of expert advice and you will information out of a reliable home loan elite dedicated to home mortgages. Extend and contact a mortgage broker who’ll help you discover the most suitable option for your along with your family’s needs.

It is vital to recognize how yet another home collateral loan can be both help to improve your financial situation, and how it can lead to problems for your money if not addressed securely. We’re going to look at the advantages and disadvantages which come which have household guarantee financing therefore the house security credit line facts.

The mortgage in order to really worth takes into account the balance that can feel due toward most of the mortgages and you can domestic lines of credit associated to your subject property due to the fact brand new home loan was processed therefore the funds is actually awarded with the borrower

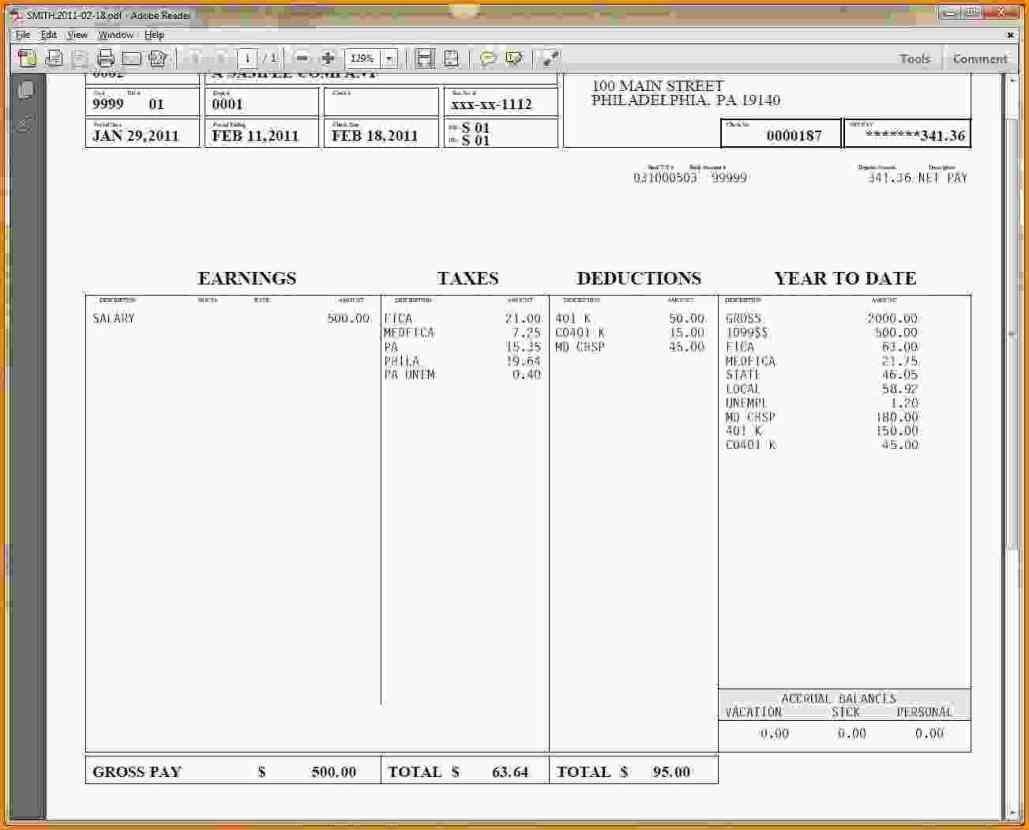

Let me reveal a map one displays the best home security loan costs in the Ontario to support your search.

How much cash might you borrow against a home collateral loan?

How much cash that can be borrowed compliment of property guarantee financing depends on numerous situations. These situations for instance the area of your house, the challenge and chronilogical age of your house, together with just what new LTV might possibly be after the security mortgage is funded.

From the Clover Mortgage we are able to representative home collateral loans one range as low as $29,one hundred thousand to as much as $a hundred,000,100 and, provided that the lender’s terminology is actually came across and that there can be enough guarantee remaining for sale in the house that is unencumbered immediately after the home financing is given. Let’s be honest, you are making a relatively high monetary and existence choice and would like to know what your choices are.