Content

- How the matching concept in accounting works

- Let’s Start the Conversation Around Outsourced Accounting Services

- Cash Accounting

- Cash Management Software

- Generally accepted accounting principles (GAAP) notionally follow the matching principle….

- Examples of the Matching Principle

- How Do a Debit and a Credit Fall in Love? The Matching Principle in Accounting

- AccountingTools

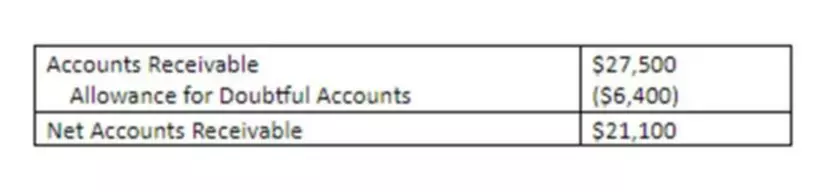

In this case, you still recognize the revenue of $7500 each month using an accounts receivable journal entry and then later move the revenue to your cash account when you receive the payments. The full disclosure principle requires entities to disclose all relevant information within their financial statements that may impact the reader’s view of the entity and further decision making. This principle is generally geared towards protecting external stakeholders as they do not know insider details about the entities books, deals, contracts, loans, and other pertinent information. However, internal IU fiscal officers must also be aware of the full disclosure principle to ensure that they are reporting complete and relevant financial information within their specific department. This will allow for IU’s finance team to better review financials, prepare budgets, and allocate resources to departments.

- For example, if ABC Consulting completes its service at an agreed price of $1,000, ABC should recognize $1,000 of revenue as soon as its work is done—it does not matter whether the client pays the $1,000 immediately or in 30 days.

- GAAP comprises a broad set of principles that have been developed by the accounting profession and the Securities and Exchange Commission (SEC).

- Accrual accounting follows the matching principal, which states that revenues and expenses should be recorded in the same period.

- The wholesaler recognizes the sales revenue in April when delivery occurs, not in March when the deal is struck or in May when the cash is received.

The matching principle and the revenue recognition principle are the two main guiding theories underlying accrual accounting. GAAP (Generally Accepted Accounting Principles) and should be used by any entity following the accrual accounting system. It says that the expenses should be matched with the revenues and recorded on the income statement in the same period as the revenues were earned. The matching principle is a part of the accrual accounting method and presents a more accurate picture of a company’s operations on the income statement. Matching is critical because it creates consistency in the financial statement, which can be skewed if expenses are recognized either in earlier or later months.

How the matching concept in accounting works

Investors typically want to see a smooth and normalized income statement where revenues and expenses are tied together, as opposed to being lumpy and disconnected. By matching them together, investors get a better sense of the true economics of the business. While accrual accounting is not a flawless system, the standardization of financial statements encourages more consistency than cash-based accounting. By contrast, if the company used the cash basis of accounting rather than accrual, they would record the revenue in November and the commission in December.

In 2010 alone, Monsanto paid $44.5 million to its two largest distributors as a rebate for meeting the sales goals of Roundup for its past rebate programs. The cost principle refers to the fact that all listed values are accurate and reflect only actual costs, rather than any market value of the cost items. This simple clarification may seem minute and unimportant, but it is this that creates a definitive and unmistakable understanding of what is meant by the term ‘cost’, creating less room for error.

Let’s Start the Conversation Around Outsourced Accounting Services

According to Gartner, 86% of finance executives aim to achieve a faster, real-time close by 2025, with more than half of respondents already investing in general ledger technology and workflow automation. Moreover, 70% of companies that have automated more than one-fourth of their accounting functions report moderate or substantial ROI. The primary difference between IFRS and GAAP is IFRS accounting is based on principle while GAAP is based on rules.

- By accruing the $900 in January, Jim will ensure that he is in compliance with the matching principle of reporting expenses in the same time period as sales.

- GAAP incorporates a general guideline known as the prudence concept which states that a company should be conservative when recording its profits while undervaluing when recording expenses and losses.

- Accrual accounting highlights the fact that some cash payments for goods or services may never be received from a consumer.

- IU is trying to secure financing to open up a new athletics facility.

- Hence, the matching principle may require a systematic allocation of a cost to the accounting periods in which the cost is used up.

- Investors and business partners — such as vendors, service providers and customers — pay attention to corporate financial reports to determine things like profitability and liquidity.

Revenues refers to the requirement that when revenue is recognised, it is reported. The objectivity principle is used to confirm that the financial statements https://www.bookstime.com/articles/matching-principle are free of opinions and biases. The intention of this principle is to increase the transparency and reliability of financial statements.

Cash Accounting

Originating from a need for finance industry regulation in post-Great Depression USA; GAAP is an important collective of fundamentals off of which the standard of practice is based within the accounting industry. GAAP is a conceptual guideline for good practice within accounting and is not a set of distinct ‘rules’ which a body or organisation is obliged to follow. All of these are situations where general principles from the conceptual framework seem to be in conflict and judgment needs to be applied to determine what application will provide the most relevant information to investors. A bonus that was earned by employees in 2020 is recorded in 2020 to match the expense to the time of the employee effort rather than in 2021 when it is objectively paid. In order to remain objective and to provide information that is reliable and verifiable, an accountant would use $32,000 the cost paid for the machine rather than use the subjective opinion of the production manager.

What is the principle of matching concept?

Matching principle is an accounting principle for recording revenues and expenses. It requires that a business records expenses alongside revenues earned. Ideally, they both fall within the same period of time for the clearest tracking. This principle recognizes that businesses must incur expenses to earn revenues.

Based on the review, the company disclosed that it was going to restate its earnings from 2009 to 2011. One of Monsanto’s flagship and highly profitable products is a weed-killer herbicide named Roundup. Because of intense competition from generic products, and possibly facing the prospect of a sharp decline in profits, Monsanto introduced an aggressive rebate program from 2009. Under the program, the company would offer steep price reductions on the product, or pay a rebate on the product in subsequent years, if retailers and distributors met certain sales goals.

Cash Management Software

By accruing the $900 in January, Jim will ensure that he is in compliance with the matching principle of reporting expenses in the same time period as sales. Another benefit is the ability to recognize and record depreciation expenses over the useful life of an asset in order to avoid recording the expense in a single accounting period. The matching principle allows for consistency in financial reporting, working off the premise that business expenses are required in order to generate revenue. Team members will receive a $1,000 bonus next year on March 15th, 2023. Since the expense is only indirectly related to revenue, the matching principle requires that the company records the bonus expense before the new year.

For example, potential losses from lawsuits will be reported on the financial statements or in the notes, but potential gains will not be reported. Also, an accountant may write inventory down to an amount that is lower than the original cost, but will not write inventory up to an amount higher than the original cost. According to many tax authorities, SaaS companies must use the accrual accounting system, which stipulates that you record revenue when it is earned, i.e., the revenue recognition principle.

Generally accepted accounting principles (GAAP) notionally follow the matching principle….

Consider the principles, assumptions and constraints of Generally Accepted Accounting Principles (GAAP). Define the expense recognition principle (sometimes referred to as matching principle) and explain why it is important to users of financial statements. The expense recognition principle, also known as the matching principle, is a generally accepted accounting principle which states that expenses need to be recognized in the period in which they incurred.

A deferred expense (prepaid expense or prepayment) is an asset used to costs paid out and not recognized as expenses according to the matching principle. First, it minimizes the risk https://www.bookstime.com/ of misstating whether a business has generated a profit or loss in any given reporting period. This is particularly important when a firm generally operates near a breakeven level.

Selling on credit, and projects that provide revenue streams over a long period, affect a company’s financial condition at the time of a transaction. Therefore, it makes sense that such events should also be reflected in the financial statements during the same reporting period that these transactions occur. Accrual accounting is a financial accounting method that allows a company to record revenue before receiving payment for goods or services sold and record expenses as they are incurred.

This is a lot to take in at once, but with practice you’ll be able to quickly deduce when and where your revenue and expenses need to be reported. Good financial statements are the heart of any business, and keeping them in order is a surefire way to keep tax authorities happy. For a subscription SaaS provider, this can mean breaking up the money received from an annual subscription into the monthly periods as the services are provided.

In other words, the revenue earned and expenses incurred are entered into the company’s journal regardless of when money exchanges hands. Accrual accounting is usually compared to cash basis of accounting, which records revenue when the goods and services are actually paid for. GAAP prefers the accrual accounting method because it records sales at the time they occur, which provides a clearer insight into a company’s performance and actual sales trends as opposed to just when payment is received. Accrual accounting requires companies to record sales at the time in which they occur.

What is an example of the matching principle?

For example, if they earn $10,000 worth of product sales in November, the company pays them $1,000 in commissions in December. The matching principle stipulates that the $1,000 worth of commissions are part of the November statement along with the November product sales of $10,000.