loan places Belleair Beach

In a number of items, you could potentially qualify for a separate home loan several many years after a property foreclosure. Nevertheless may need to hold off offered.

Many people that undergone a foreclosures ponder in the event that they are going to ever manage to purchase property once again. Credit reporting agencies could possibly get declaration foreclosure on the credit history for 7 many years following the basic skipped fee that contributed to new foreclosure, expanded while seeking that loan to own $150,000 or even more.

However, possibly, it could take below 7 age to acquire a different sort of home loan just after a foreclosure. Committed you have got to hold off before getting an effective the brand new mortgage utilizes the type of loan plus economic things.

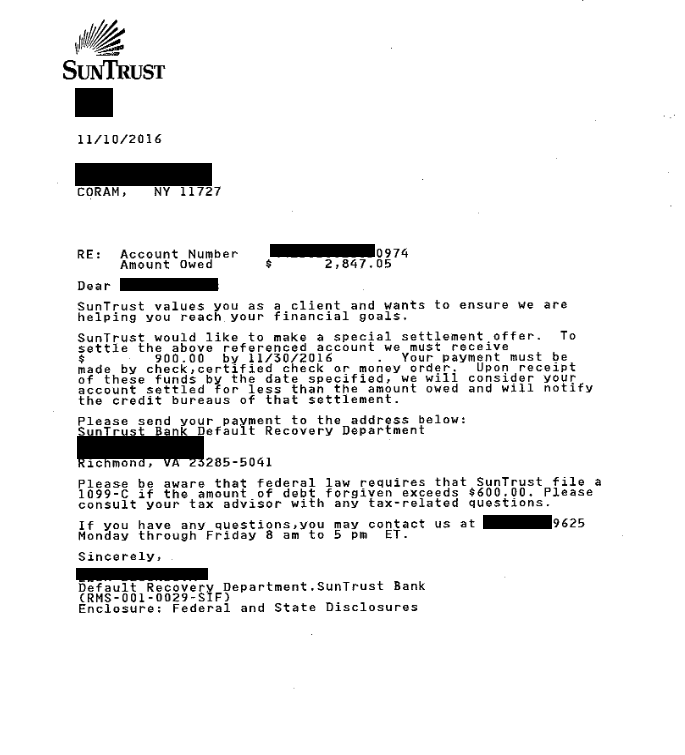

The chart less than suggests how long the waiting period is immediately following a foreclosure a variety of categories of money, with information below.

Including, a foreclosures can cause a serious decrease in the fico scores, so it is more complicated to locate a new mortgage. How much your own score commonly fall relies on the effectiveness of your credit before dropping your house. Should you have expert borrowing just before a foreclosure, that is uncommon, the scores is certainly going off more than if you’d currently had late otherwise missed repayments, charged-of levels, or any other bad belongings in your credit reports.

Whether you should buy financing, even after the new wishing period ends, utilizes how good you have remodeled their borrowing adopting the foreclosures.

Waiting Months having Federal national mortgage association and you can Freddie Mac computer Money After Foreclosures

Specific mortgage loans comply with assistance your Federal Federal Home loan Association ( Fannie mae ) together with Federal Financial Financial Corporation ( Freddie Mac computer ) lay. These money, entitled “antique, conforming” fund, qualify to appear to Fannie mae otherwise Freddie Mac computer.

Before , new prepared months for a separate mortgage pursuing the a property foreclosure is 5 years. Today, so you can qualify for that loan significantly less than Federal national mortgage association or Freddie Mac advice, you must always wait at the least eight decades immediately after a foreclosures.

Three-Year Wishing Months To possess Extenuating Factors

You happen to be able to shorten the fresh new prepared period to three many years, measured throughout the end time of foreclosures step, to own a federal national mortgage association otherwise Freddie Mac loan in the event the extenuating issues (that’s, a posture that was nonrecurring, outside the handle and you will resulted in a rapid, tall, and you can prolonged loss of earnings otherwise a catastrophic boost in monetary obligations) was the cause of foreclosure.

- establish the foreclosures is actually caused by extenuating activities, such as for example splitting up, problems, sudden death of domestic income, or job losses

- having Federal national mortgage association, has actually a maximum mortgage-to-worth (LTV) proportion of one’s this new home loan regarding often ninety% or the LTV ratio placed in Fannie Mae’s qualifications matrix, any kind of is better

- to own Freddie Mac, has actually a maximum loan-to-really worth (LTV)/total LTV (TLTV)/Domestic Collateral Credit line TLTV (HTLTV) proportion of your lesser off 90% and/or maximum LTV/TLTV/HTLTV ratio towards transaction, and you may

- use the this new home mortgage to buy a principal residence. (You simply can’t make use of the mortgage to shop for a second household otherwise investment property.)

Wishing Months having FHA-Insured Finance After Property foreclosure

To be eligible for that loan your Government Construction Government (FHA) assures, your typically need hold off at least three years once a property foreclosure. The 3-year clock begins ticking in the event the foreclosures circumstances is finished, always from the date your house’s term moved because a good results of the foreclosure.

If the foreclosure also involved an FHA-insured mortgage, the 3-12 months waiting several months starts when FHA paid off the earlier financial to the their claim. (For people who treat your residence in order to a foreclosures although property foreclosure sales speed doesn’t fully pay-off an enthusiastic FHA-covered mortgage, the financial institution produces a claim to the latest FHA, while the FHA compensates the financial institution on the losings.)