Knowing the costs and you may will cost you out-of refinancing your residence mortgage

Whenever you are contemplating refinancing your home financing, this task-by-action publication demonstrates to you what to anticipate and how to navigate the process.

With rates on a pretty much all-day reduced around the Australian continent, listing amounts of people are employing the ability to see far more cost-productive otherwise flexible revenue on their lenders 1 . Just what, just, will it mean to help you refinance a property, incase is it useful?

Refinancing can mean conversing with your vendor to renegotiate your own arrangement together (an inside refinance), but it have a tendency to identifies switching to a separate financial in order to safer a better bargain (an external refinance).

There are lots of reasons why you should think refinancing, out of saving money by eliminating your month-to-month costs, so you’re able to reducing the label of the mortgage, so you’re able to opening loan features that better suit your needs, and merging most other costs (for example unsecured loans otherwise car and truck loans) in one straight down price.

Begin by playing with good re-finance calculator to find an idea of what you can rescue by the refinancing. After that crunch the new quantity towards the home financing evaluation calculator so you’re able to contrast your mortgage with other example finance, observe what would work most effectively to you personally.

It is also best if you consider whether the financial professionals of reworking the loan surpass any potential fees and will set you back.

There are plenty of reasons why you should think refinancing, from saving cash in order to merging other expenses at the same all the way down rate.

Yes, a corner away from refinancing is focused on saving money on longterm by getting a better rate on the home loan. Prior to you make the alteration, it is preferable to ensure you’ll receive all else your require, also. Speaking of a number of the home loan possess one to Amplifier has the benefit of according to unit; other loan providers you’ll give comparable or different options:

- The fresh studio while making even more money instead of punishment into the varying-rates financing

- Multiple financing breaks (between repaired and you will varying) on no extra costs

- The ability to redraw for the variable mortgage brokers

- Online and you will mobile financial

- Zero annual plan charges

- Zero monthly membership administration charge

- Like how you pay off by the loan that have prominent and you may attention, otherwise attract simply costs

- Make more repayments towards the loans

- Financial assistance inside valuation charges

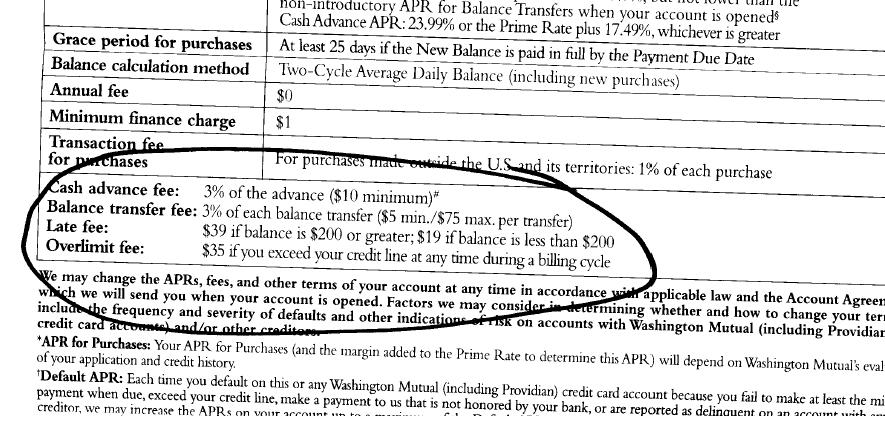

One which just get also involved in contrast-hunting, also be conscious you could come upon one another small-label and ongoing charge when refinancing your home loan. These could is:

If you have compared home loan choices in the industry, run new figures, and determined that the advantages of refinancing outweigh the expenses, the next thing is to put in a credit card applicatoin with good the newest bank.

A file record to have refinancing your home loan

With respect to refinancing your house loan with a new bank, its smart to get waiting. A loan provider will normally like to see:

You’ll also need certainly to complete an application form, that may need some of a lot more than information in addition to info about your dependents, property https://elitecashadvance.com/loans/loans-for-bad-credit/ and you may obligations, the intention of the mortgage, the mortgage count you happen to be seeking to as well as your monthly expenditures. Then you will must likewise have specifics about the property in itself, such as the term deeds.

Just how to get-off your current mortgage

The next step is doing a mortgage Release Power Form along with your latest bank extremely loan providers enjoys such on line. This will want to know regarding the property, an important individuals in it, additionally the financing account details. It will likewise give you information on lender charges and any regulators charge you will deal with after you finalise your log off software.

Leaving your existing mortgage and you can making an application for a different that should be an occasion-taking techniques. An amp mortgage professional can take the pressure away from refinancing and automate the whole process of app by liaising together with your most recent lender to establish their leave charges, done their discharge means and safe the property’s title deeds.