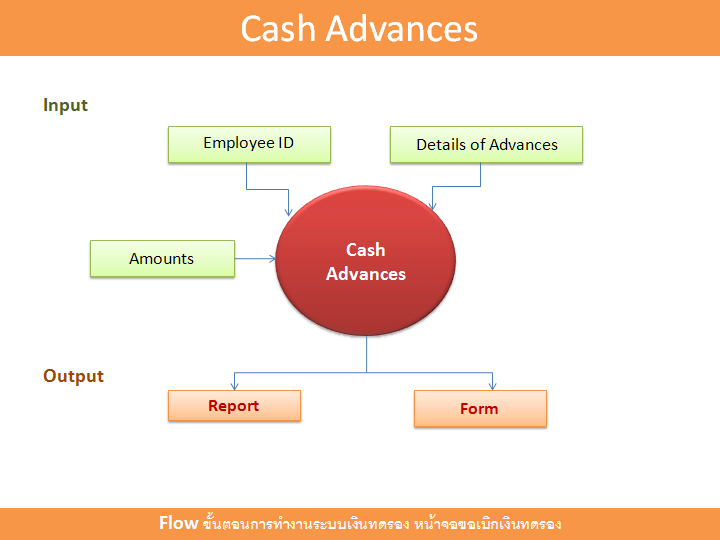

How financing automation can increase functional efficiency and you may boost knowledge

A typical home mortgage duration can take more 45 days , to your origination costs for each and every financing amounting up to $9,100000.

With many lending process today digitized, the thing that makes the borrowed funds financing years however big date- and value-extreme? On of several traditional loan providers, credit communities are coping with papers-depending paperwork and you may switching ranging from several different software solutions – besides in app phase, however, round the running, underwriting, and you may closure as well.

Doing financing, financing officials are also frequently delayed while they must hold off to possess consumers to locate key files to confirm the money, employment, and much more. Meanwhile, as many as five underwriters need involved in risk assessment and confirmation, ultimately causing even more bottlenecks.

This case try from better which can be hampering financing officer cluster efficiency. Additionally, it is charging financial providers beneficial business, to some extent as the clients are becoming lured from the capability of solution fintech products. Indeed, there’s a good 2030% difference in client satisfaction scores between consumers during the antique lenders and the individuals at the fintechs – whom often have more modern, digitized processes.

To help keep their businesses afloat and you can peak up against the crowd, lenders need to make by far the most of any lead they score. Just how do they achieve this? You to strategy has been automation.

Just how loan automation is actually streamlining each step of one’s credit techniques

Which have automation, one may change the finish-to-prevent financing lifecycle, regarding the first application on control, underwriting, last but most certainly not least closing. Why don’t we explore the opportunity of mortgage automation when you look at the five key areas.

The applying

Loan automation takes much of the effort out of the application processes. As opposed to being forced to yourself fill in report application forms – and that is countless pages enough time – the whole techniques will likely be sleek thanks to digitization. Research entry are minimized given that areas was pre-full of linked study and you may pointers the user has furnished inside going back. While doing so, the application circulate are going to be dynamically upgraded using guidance the user keeps inputted in past times. Additional enjoys particularly debtor solitary indication-to your out-of one product and the automatic flagging off wrong advice makes the procedure far more productive – reducing the need for financial help.

Florida-dependent Lennar Mortgage is utilizing loan automation to transmit an only-in-class software procedure for its users. We get the right feedback into the our very own electronic home loan process as being simple, user friendly, and you can informative, said Tom Moreno, Lennar’s master recommendations administrator.

Lennar’s Internet Supporter Get illustrates the latest impression mortgage automation has received for the customers sense. Lennar customers using a digital software scored the lending company 42% higher toward NPS scale.

Processing

Over the years, lenders experienced to spend a lot of time chasing off help files off borrowers. Mortgage automation, although not, produces the process smoother. Individuals can discover automated checklists out-of document collection conditions, and these shall be automatically modified for the brand of needs of this new candidate. This will be backed by the real-day checking out-of entries in order to banner completely wrong otherwise wrong data files and you will studies, handling facts just before underwriting actually happens. Overall, financing automation decrease bottlenecks and you may manages one oversights thus financing even offers is focus on what truly matters extremely: customer support.

By using financing automation for handling programs, real estate loan officers in the Indiana-situated Elements Financial today save money time get together data files and a lot more time interfacing through its people and you may expanding its team.

Indeed, Issue Financial possess faster the common member’s home loan software-to-funds day by four calendar days. Just is actually i providing a regular affiliate feel … but the professionals are completing the software easier and you will changing within large cost, told you Ron Senci, EVP, conversion process and you can credit during the Issue.

Underwriting

Verifying and you will verifying suggestions can lead to high waits regarding underwriting stage, but automation throughout the prior to amount might help automate this type of standard circumstances. Studies connectivity integrated from inside the digital app flow allows a hefty part of the confirmation work to exist during the time of application. Involvement with possessions, payroll, income tax profile, and other 3rd-class data provide may help boost accuracy and, oftentimes, support expedited if not instant verification and you will approvals. It’s a profit:profit circumstance – minimizing rubbing towards borrower and you can boosting abilities into the lender.

Credit groups also can explore mortgage automation app in order to arrange risk guidelines, tolerances, outcomes, and you may stipulation requests. By the modernizing workflows like this, loan providers normally improve guidelines underwriting process https://elitecashadvance.com/payday-loans/ otherwise automate quicker state-of-the-art approvals entirely. Not only can which trigger reduced years moments and you will quicker can cost you, it may also totally free underwriters to target large-analysis apps.

Texas-centered SWBC Home loan is utilizing loan automation app, and it has managed to clipped mortgage duration date of the 28% during the a two-times airplane pilot.

I have already been moving call at-house and you may outside circumstances for three decades, and you will I have never ever experienced something that went as easily and efficiently that implementation, told you Debbie Dunn, master working officer at SWBC Financial.

Closing

The full advantages of automation is only able to end up being unlocked when lenders improve move in order to electronic closing workflows – efficiencies in advance would be minimized otherwise destroyed completely when the past actions of techniques return so you’re able to tips guide, antiquated relations. From inside the progressive closure options, studies syncing and you can document preparation might be automated, due to integrations having LOS, eNote team, and you will eVaults. This can prevent signing mistakes and you can lost files, signatures, or schedules, and work out to possess a streamlined and you will quicker closure processes. Amarillo National Bank from inside the Texas is utilizing financing automation software to streamline new closing procedure. It is doing so by automating closing file planning and you can enabling closing teams to deliver data on the payment agent to help you conduct info ahead of sharing all of them with the fresh new debtor.

The pros were significant. We’ve been able to see less capital moments, told you Lauren Lyons, older program officer. With files coming back electronically, it increases the trunk and you will onward interaction.

Unleashing the fresh new efficiencies, out-of app to shut

The end result? Financing groups has actually a lot more time to work on getting the significant solution that leads to raised consumer event and you will enough time-title respect.