Everything you desired to find out about PMI (individual financial insurance rates)

Into Oct, i composed a couple blogs articles in the financial terminology that you should familiarize yourself with if you find yourself looking for a property. Take a look right here that is where . In just one of people posts, we touched towards the individual home loan insurance policies, otherwise PMI, but believe it merited a much deeper diving. So right here it goes:

The outdated guideline was you to definitely borrowers had to started with a 20% deposit to buy property. That is not effortless especially in the current Realtors Trust List Survey , 75% regarding very first-big date people had less than 20% saved up having a downpayment. If you find yourself incapable of help save that much, a loan that have an inferior down-payment remains doable, however, it’ll probably have personal mortgage insurance rates .

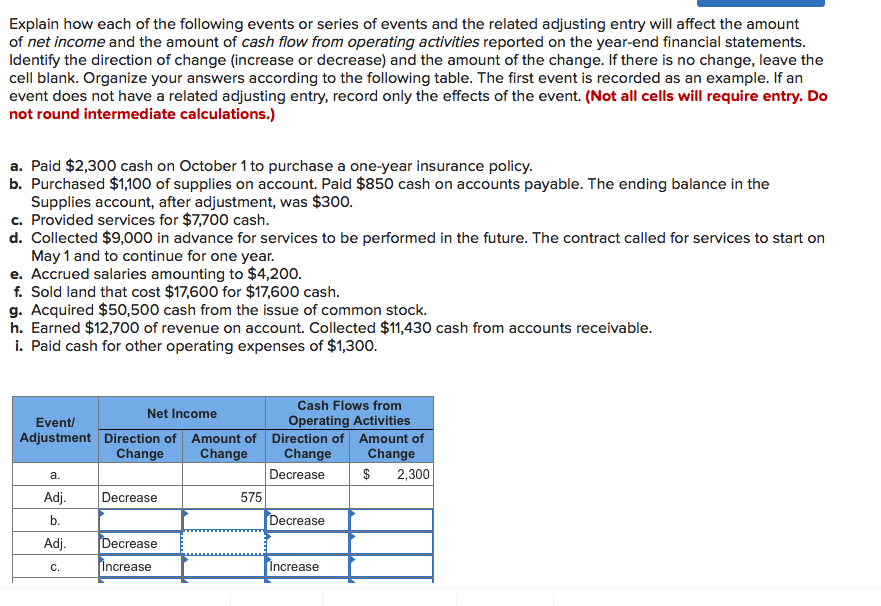

Exactly why do I want to take-out individual financial insurance policies?

Credit currency to order a house when you don’t have the full 20% of the property’s price tag to utilize once the a down-payment makes you a much bigger risk in order to a loan provider. Private home loan insurance rates assists offset you to definitely chance and produces a loan provider likely to agree your house application for the loan.

Just how much PMI costs depends on the house’s price and you may the degree of their advance payment, and additional factors we are going to number afterwards americash loans Eads contained in this site. Their lending company are working having an insurance coverage provider to come up with a fact and you will talk about the price along with you prior to requesting to agree to the mortgage. Recall, whenever you are PMI allows you to bypass a lower deposit, monthly home loan repayments increases a little (given that you may be getting off less overall and you can then credit even more.) Luckily, PMI are not in force into the lifetime of the loan.

5 sort of private financial insurance

With respect to the form of family you want to purchasing and you may the kind of capital you’re applying for, your We may be one of several adopting the:

- Borrower-paid financial insurance coverage

Borrower-paid back home loan insurance policies (BPMI) was recharged on homeowner towards the top of – and regularly utilized in – the fresh month-to-month homeloan payment. While you are upwards-to-time on your mortgage payments, BPMI try automatically canceled once you’ve twenty-two% security in your home.

- Lender-paid back financial insurance coverage

To store insurance policies repayments out of leading to your month-to-month personal debt, you could potentially investigate financial-paid back financial insurance policies (LPMI). But never envision you’re going to get away which have some thing; in exchange for remaining normal costs down, you get a slightly highest rate of interest – so, in essence, you are still paying. Something to watch out for with this specific insurance coverage type of are that since the its incorporated into the loan, it is far from cancelable, despite you are free to 22% guarantee. The only way to escape its to refinance.

- Single-advanced home loan insurance policies

Also known as SPMI, single-premium financial insurance policies allows you to spend initial completely from the closure. So it enjoys home loan repayments below if you were to disperse give having BPMI. You will find a danger, however. All your SPMI is low-refundable, and this can be difficulty if you were to think you are refinancing otherwise attempting to sell your home within this many years. On the other hand, you can loans their SPMI for the loan, but you are paying interest involved for as long as you carry the mortgage therefore monthly premiums creep right up again. Along with, not all bank has the benefit of SPMI, so do not assume it’s going to be a choice.

- Split-superior financial insurance coverage

There is no enjoy acronym because of it one to. Split-premium financial insurance coverage version of acts like a great mash-right up of SPMI and BPMI. Including the unmarried-superior, it is possible to pay a lump sum payment initial, but it will be about 50 % of total price. The others try treated instance debtor-paid off mortgage insurance rates, for the reason that its reduced through the years. Which provides you with straight down monthly bills (although notably less lowest like with SPMI) without having to assembled all of that cash within closure. Just after mortgage insurance is canceled otherwise terminated, a partial reimburse are you’ll be able to.

- Government financial financial shelter

If you find yourself to acquire a property with an FHA loan – hence, in addition, is great for customers just who lack the finance to own a full down payment – you might be given private mortgage insurance policies yourself from Federal Homes Government. This form is named MIP that’s needed for most of the FHA money carrying lower than a ten% down-payment. Think of it because the an initial fee with monthly premiums. But including the lender-paid down financial insurance policies, MIP cannot be ended in place of refinancing our home completely.

The final stuff you need certainly to undertake when buying a good household was more costs. But if you can not built the 20% down payment that’s normal for most mortgages, agreeing to invest PMI is an excellent way to get the newest financial observe your given that less of a risk.

PMI rates is very personal and can may include debtor in order to borrower. Expect to pay at least 0.3% of your loan amount, per year, and often even more. What if that you will be looking at a home costing $200,000. Whether your PMI comes in during the step one.5%, you will end up paying $step 3,100000 annually, annually, or just around $250 thirty day period.

You’ll want to discuss the PMI can cost you with your loan administrator just before agreeing so you can home financing. To be better-informed, take note of what facts go into determining the new superior you’ll feel against. They will tend to be:

- Sorts of house (first or secondary household, investment property, etcetera.)

- Version of mortgage (conventional, FHA, jumbo loan, refinance, an such like.)

- Period of the loan title

- Credit history

Must i prevent purchasing PMI?

How you can escape investing personal home loan insurance coverage will be to save up having a beneficial 20% downpayment. In the event that’s extremely hard, explore a government-covered loan. For example, if you have served regarding military, your I. An identical holds true for an effective USDA mortgage , which helps reduced- and reasonable-income family members purchase homes when you look at the rural regions of the world.

When you yourself have no options apart from to take out an effective mortgage which have PMI, request you to definitely having terms and conditions where you can terminate since the in the near future since you have 20% equity inside your home or an enthusiastic LTV out of 80%.

Speak with a neighborhood loan administrator or use online

Are you currently a potential homebuyer having a concern in the personal mortgage insurance? Reach out to our local financing officers to discuss your options. Otherwise, if you’re willing to start now, you can implement online !

Regarding the Creator: Mitch Mitchell

Mitch Mitchell is a freelance contributor so you can Movement’s product sales agency. The guy and writes on tech, online security, the brand new electronic education people, travelling, and you may living with pets. He would need alive somewhere loving.