Which vendor feet provides continuously brought incredible credit and you may prepayment performance

The majority of people aren’t very aware the FHLBank Program try the very first property government-backed company, established into the 1932. In contrast, Federal national mortgage association try oriented during the 1938, and Freddie Mac computer from inside the 1970. Therefore, we have been helping the users for some time. And, how big is the FHLBank System as well as character within the property is big. Inside 2016, i exceeded $step one trillion in the FHLBank Program assets, many of which are homes and you may mortgage-related. Our very own subscription even offers xxx over the years today they is higher than 6,800 participants. Registration is limited to depository intuitions, credit unions, insurance providers and you can neighborhood development creditors.

We up coming securitize those individuals fund for the GNMA MBS

The newest FHLBank il become and you can manages this new MPF system towards part of FHLBank System. When MPF were only available in 1997, we’d half dozen approved suppliers, now you will find more than 2,100. More over, the applying craft has grown drastically nowadays just like the 2011, i’ve additional more than 650 Participating Loan providers (PFIs) and you may per year reached everything 900 productive financing vendors, therefore invited and you will use of the MPF System provides most expidited after and during the fresh housing drama with these people. What is actually most novel in the our people is because they aren’t the latest Top ten financial originators nor people non-banks. All of our clients are generally smaller neighborhood banking institutions and you will credit unions. Such, during the last couple of years, 55% out of MPF Program effective vendors try associations that have $five-hundred mil otherwise less for the property. And thus, since the do not have of top ten originators in the the applying and not one of the highest independents mortgage banks as we has many suppliers, we do not have the commensurate volume because we have an effective very different reputation.

Also, it is worthy of bringing-up the MPF System now offers a product called MPF Authorities MBS which allows all of our members in order to originate elitecashadvance.com single payment loan example and you may promote FHA, Va, and you will RHS finance to your FHLBank Chicago’s Bucks Window. The item helps quick lenders in addition to their communities has liquid resource to own bodies loans toward a servicing hired or released basis.

Finally, this new FHLBanks was novel inside our help all over the country of sensible construction. 10% of all the FHLBank net income gets into all of our reasonable construction apps, starting a direct positive impact on teams where all of our professionals efforts.

Really, I do believe brand new casing crisis produced otherwise need to have produced a lot of home loan professionals rethink its work and just how they can improve which business. Including, this new crisis gone me on the diversity space specifically whenever i read the data and that demonstrated the brand new disproportionate display regarding poisonous large-rate, fast-reset dos/twenty eight and you may 3/27 subprime money was indeed ended up selling so you can minority individuals, for the resulting disproportionate display of foreclosure and you can domestic rates depreciation when it comes to those fraction neighborhoods. You don’t need to browse extremely far observe that it. Since the casing crisis is finished for the majority of American household, it is still on going within this new South and you will Western corners regarding Chi town. Home prices are nevertheless depressed. So, like We told you earlier: The original half of job means triumph; last half concerns value. There was an effective chance to help improve the options getting these types of household. To them, and also for me personally, homeownership represents a beneficial family members’ well-are and you can coming financial wellness a thing that must be within reach of the many People in the us, no matter their class.

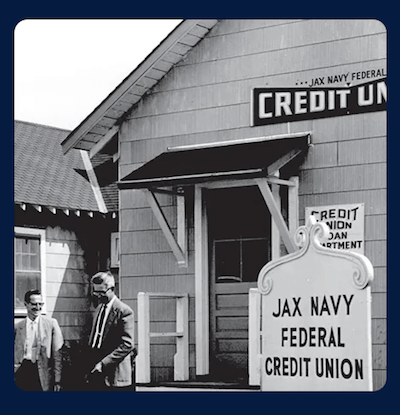

Since the drama We have handled improving diversity and you will introduction, toward driving an understanding around modifying construction demographics at the bank sufficient reason for our very own Panel, moving having deeper usage of varied companies and people and you may I’ve invested long towards the construction finance reform jobs regarding FHLBank Program tied to helping perform an excellent most readily useful financial markets afterwards for people all of the. They are characteristics and attributes doing leadership and you can ethics and that I discovered growing right up in my relatives and while being taught given that a beneficial Naval officer throughout the the individuals very early ages.